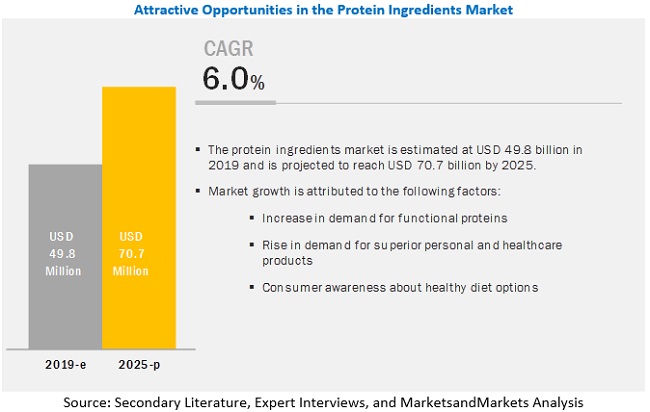

The report "Protein Ingredients Market by Source (animal [dairy, egg, gelatin] and plant [soy, wheat, vegetable]), Form (dry and liquid), Application (food & beverages, feed, pharmaceuticals, and cosmetics & personal care products), Region – Global forecast to 2025" The protein ingredients market is projected to grow from USD 49.8 billion in 2019 to USD 70.7 billion by 2025, at a compound annual growth rate (CAGR) of 6.0% during the forecast period. The major factors driving the protein ingredients market include the increase in demand and consumption of functional food & beverages, growing consumer awareness about healthy diets among people, and increasing demand for protein as a nutrition and functional ingredients.

Entering new sections through customization is a major opportunity for manufacturers

Manufacturers have been using functional properties of soy protein ingredients in developing versatile food products. Several new products such as in nut butter, cheese, burgers, and instant oatmeals have been launched by the manufacturers of soy protein ingredients. New sectors such as healthcare foods and sports beverages can provide a better market opportunity for soy proteins. These sectors can boost the growth of soy protein production if they are manufactured in a customized way. With advancements in technology, soy proteins can be isolated and functional properties can be enhanced to provide a wider scope of application.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=114688236

Demand based price fluctuations are a major challenge for players in protein ingredients market

Even though the prices of soy proteins are comparatively lower than most of the proteins, the supply can prove to be a significant factor in price escalation. The raw material for soy protein ingredients is soy meal, which is also highly demanded by the feed industry. Unless there is no drop-in cultivation area under soybeans, the supply is expected to remain unfazed for both feed and protein manufacturers.

The plant source of the protein ingredients market is projected to be the fastest-growing, in terms of value.

The demand for plant sourced protein has increased due to changing consumer preferences from meat to plant-based protein. In addition, plant-based protein ingredients are a major source of protein for vegans worldwide. High nutritional profile, low carbon footprint, and low price of plant-sourced protein are driving the consumption of these proteins. It is also gaining an increasing level of importance due to its lower energy consumption, emissions, land usage, and water

consumption; it also offers better input conversion efficiency.

Animal based proteins are dominating the global protein ingredients market.

On the basis of source, the market for protein ingredients is classified into animal and plant protein. The demand for animal-based protein ingredients held a dominant share in the protein ingredients market across regions, particularly in North America and Europe, where the consumption of animal-based protein remains high.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=114688236

Asia Pacific is projected to be the fastest-growing region during the forecast period.

Asia Pacific is projected to be the fastest-growing region during the forecast period. The market in the region is driven by increase in population growth especially in countries such as China and India. Further, rise in demand for healthy food products having high nutritional value such as soy, wheat, and vegetable protein is driving the market in this region.

Major vendors in the protein ingredients market include Cargill (US), ADM (US), DowDuPont (US), Kerry Group (Ireland), Omega Protein Corporation (US), Friesland (Netherlands), Fonterra (New Zealand), Arla Foods (Denmark), AMCO (US), Roquette (France), Gelita AG (Germany), Kewpie Corporation (Japan), AGARNA (Austria), AMCO Proteins (US), Hilmar Ingredients (US), Axiom Foods (US), and Burcon Nutrascience (Canada).

Recent Developments:

In August 2019, Cargill (US) invested USD 75 million to expand the production capacity for PURIS Pea protein at its Minneapolis facility due to surge in the demand for pea protein. This initiative was strategically taken by witnessing a growing demand for plant-based protein in the North American region. Through this they aim to cater to a large number of customers with tasty, sustainable and label-friendly pea protein across North America.

In July 2018, ADM (US) and Cargill (US) launched their new joint venture SoyVen in Egypt to manufacture soybean meal and oil for customers in Egypt. Both the companies hold equal interest in the company. Their production plant is located in Borg Al-Arab whose daily production capacity is doubled to 6,000 MT, witnessing a growing demand for higher-protein soybean meal and oil by the Egyptian customers. This will also lower down the need for imports from the international markets.