Beverage flavoring systems are a mix of different components, based on natural, nature-identical, or artificial ingredients being combined to create novel flavors. Beverage flavoring systems are regarded as semi-finished products having a limited shelf life and are manufactured according to the highest quality requirements, making production procedures easier, by providing customized flavor solutions for the beverage industry.

With the growing awareness, consumers are looking for healthy alternatives with functional properties and are more inclined toward drinks with natural flavors, natural ingredients, and those that serve functional properties, while also avoiding high-sugar consumption. Natural flavors required in functional drinks should be derived and added from herbs, trees, fruits, or flowers. This promotes the growth of clean-label flavor systems with natural ingredients for various beverage applications.

Some statistics reflecting the growth in fortified drinks consumption are mentioned below:

- According to Natural Product Insider, energy drink consumption in the US among the 27 to 37 age group population increased from 55% in 2014 to 61% in 2015.

- According to the 2013 Energy Drinks Report published by the European Food Safety Authority (EFSA), about 41% adolescent and 52% adult population in Europe consume energy drinks during sports activities.

- According to a report published by Beverage Industry magazine in 2017, the sales of juice concentrates in the US increased by 4.5% in 2017 as compared to 2016.

The global beverage flavoring systems market was valued at USD 3,692.2 million in 2017. It is projected to grow at CAGR of 6.1% from 2018 to reach USD 5,215.6 million by 2023. This growth is attributed to the growing demand for beverages including fortified and non-fortified drinks across the world.

The beverage flavoring systems market, by beverage type, is segmented into alcoholic and non-alcoholic beverages. The market was dominated by the non-alcoholic beverages segment in 2017. The non-alcoholic segment is projected to grow at a significant rate due to the growing consumption of carbonated soft drinks, fruit- & vegetable-based juices, and functional drinks. The carbonated soft drinks and juice industries are major application areas of flavoring systems to enhance the taste of certain drinks. Consumer demand for innovative tastes encourages flavor manufacturers to launch new flavor products. Unusual flavors such as tropical fruits, herbs & spices, floral flavors, beer-flavored non-alcoholic beverages, smoked flavor beverages, and vegan dairy flavors are receiving global attention.

Inquiry before buying @

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=138195769

The use of flavoring agents is estimated to dominate the beverage flavoring systems market in 2018

The various components of the beverage flavoring systems include flavoring agents such as flavors, taste modulators & taste-masking agents, flavor carriers, flavor enhancers, and other ingredients, which include curing & pickling agents, preservatives, acidity regulators, emulsifiers, and stabilizers. Flavoring agents are additives that are used to enhance and modify the flavors of beverages. These are further sub-segmented into flavors and taste modulators & taste-masking agents and are an integral part of any flavoring system. For instance, flavor masking agents are required to mask the harsh taste of functional ingredients such as proteins or high-intensity sweeteners present in the beverages. Firmenich (Switzerland) offers Mask-IT, a flavor masking agent, which can be used to mask bitterness. The flavoring agents segment accounted for the largest share of the beverage flavoring systems market.

Key Developments in the Market:

Sensient Technologies (US), Givaudan (Switzerland), International Flavors and Fragrances (IFF) (US), Firmenich (Switzerland), and Symrise (Germany) are among the key players in the market. The market players focused on various development strategies such as new product launches, expansions & investments, acquisitions, partnerships, mergers, and collaborations in the last few years to meet the growing demand for beverage flavoring systems.

Some of the major developments in the market are listed below:

- In August 2018, ADM (US) opened its new technical innovation center in Shanghai, China, to support the development and creation of innovative and nutritious products. This center would help the company to accommodate the increasing demand for nutritional food & beverage products in the Asia Pacific region.

- In September 2018, Givaudan (Switzerland) acquired Naturex (France), with an aim to cater to the customers across the food & beverage, nutrition, and health & personal care sectors with natural, clean labeled, and organic products.

- In June 2018, Firmenich (Switzerland) launched its Natural and Clean Label platform through which it would provide the natural, authentic, and traceable products to gain customer and their trust.

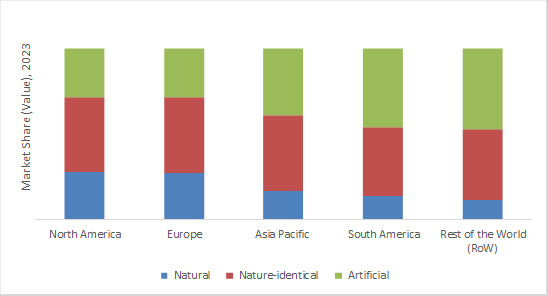

The market for nature-identical flavoring systems is growing worldwide due to cheaper sources of these flavoring systems. Nature-identical flavoring systems are preferred by the industry, because they are less expensive than the natural ones, easily available, and have a molecular structure similar to the natural flavors. It is impossible to meet the large demand for natural ingredients due to lack of availability of required quantities. This is fueling the demand for nature-identical products in the market.

Market Drivers:

- Growth in demand for a variety of innovative flavors in soft drinks

With the growth in the soft drinks market, the demand for innovative beverage flavoring systems is also rising at a fast pace due to consumer inclination toward innovative flavors.

Some of the latest innovative beverage flavor system launches in the market are as follows:

- In June 2017, IFF (US) launched its Tastepoint program to offer a differentiating taste in alcoholic and non-alcoholic beverages.

- In July 2017, Tate & Lyle (UK) launched ‘Taste for Adventure’ flavor range, which includes dark soft brown, organic dark soft brown, golden caster, organic golden caster, and demerara.

- In June 2018, Firmenich (Switzerland) launched its natural and clean label platform through which it offers natural flavor systems for beverage manufacturers.

- Launch of advanced technologies for flavor processing

Companies are adopting new technologies such as advanced extraction and non-thermal processes to produce better varieties of beverage flavoring systems with natural and synthetic ingredients for more stability and suitability.

Some other technologies used in beverage flavoring systems for various functions and that have fueled the market growth are as follows:

- Dry blending

- Retorting

- Tunnel pasteurization

- Spray drying

- Agglomeration

- Encapsulation

- Consumer inclination toward clean-label and organic products

The growth in demand for plant-based or natural origin flavor systems is attributed to consumer awareness about clean-label products. This has led beverage manufacturers to adopt flavor systems incorporated with clean-label ingredients. According to a study published by the Journal of Food Science in 2017, consumers are willing to pay more for food products labeled as “all-natural” as compared to products without labels. This factor fuels growth of the beverage flavoring systems market players to launch innovative natural products.

Speak to Analyst @

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=138195769

Asia Pacific is projected to dominate the market through 2023

The Asia Pacific market dominated in 2017 due to the increasing demand for carbonated soft drinks across the region. The region is an emerging market with investments from several multinational manufacturers, especially in countries such as China, India, and Japan; these are the major markets in the region. According to the World Economic Forum, the per capita consumption of carbonated soft drinks has been increasing in India, which is a potential market for carbonated soft drink flavor system manufacturers.