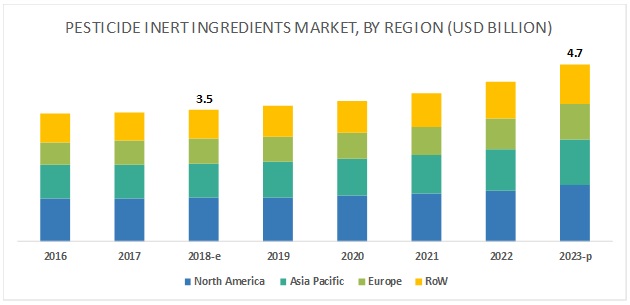

The report "Pesticide Inert Ingredients Market by Type (Emulsifiers, Solvents, and Carriers), Source (Synthetic and Bio-based), Form (Dry and Liquid), Pesticide Type (Herbicides, Insecticides, Fungicides, and Rodenticides), and Region - Global Forecast to 2023", The pesticide inert ingredients market is projected to reach USD 4.7 billion by 2023, from USD 3.5 billion in 2018, at a CAGR of 6.14% during the forecast period. The market is driven by factors such as the increasing demand for specific inert ingredients in pesticide formulation and capability of inert ingredients to improve the efficacy of pesticide application.

On the basis of type, the emulsifiers segment is projected to witness the fastest growth during the forecast period.

Emulsifiers help in stabilizing the mixture of two liquids and avoid the formation of immiscible liquid phases. Major emulsifiers that are used as inert ingredients are polymers, nonylphenol and alcohol ethoxylates, and alcohol alkoxylates. The demand for emulsifier-based products remains high in the North American region due to the increasing industrialization and decreasing land area for agriculture, which in turn, creates demand for the use of pesticides for ensuring food security and production.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=176580687

With the increasing demand for organic fruits and vegetables, the bio-based segment is projected to witness the fastest growth, on the basis of source.

It has been witnessed that some of the inert ingredients used in pesticide formulation are more toxic than the active ingredients. Increasing health hazards associated with the usage of synthetic-based inert ingredients in pesticides creates an opportunity for the market players to develop bio-based inert ingredients from sources such as microbes for the formulation of bio-based pesticides. Governmental bodies and regulatory authorities have introduced regulations for the use of toxic pesticides, which affects the growth of bio-based inert ingredients in the market.

On the basis of form, the liquid segment is projected to account for a higher share in the pesticide inert ingredients market during the forecast period.

Liquid inert ingredients reduce waste and have a larger target coverage area. In addition, the uniformity and ease in mixing the liquid inert ingredients in pesticide formulations are key factors driving the demand for these forms among local manufacturers in developing countries. Thus, the liquid segment is estimated to dominate the pesticide inert ingredients market. Most of the pesticide formulations are also available in liquid form and thus the share for the liquid segment is projected to remain high.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=176580687

Asia Pacific is projected to witness the highest growth in the pesticide inert ingredients market during the forecast period.

The Asia Pacific region is one of the leading consumers of pesticides across regions, even though the region mainly depends on imports for pesticide supply. Inert ingredients are increasingly consumed by pesticide manufacturers at the production facility during the formulation stage, and countries such as India, Thailand, and Vietnam depend on imports for pesticides. Hence, the market for pesticide inert ingredients remains smaller when compared to the Americas and Europe. However, the pesticide inert ingredients market is well-established in developed countries with the increasing establishment of production plants in the Asian countries. Due to these factors, the use of inert ingredients along with pesticide application is projected to increase in the future.

Key Market Players:

Major market players in the pesticide inert ingredients market are BASF (Germany), Clariant (Switzerland), DowDuPont (US), Stepan Company (US), and Croda International (UK). BASF SE (Germany), one of the world’s largest chemical companies, operates through seven major segments. With a broad product range, diverse customer base, and operations in more than 80 countries through its joint ventures and subsidiaries, the company has marked its presence on the growth trajectory. DowDuPont is another leading player wherein, Dow Crop Defense focuses on providing inert and additive ingredients, which enhances the effectiveness of pesticides and adjuvant formulations. This, in turn, helps farmers to produce and offer healthier crops. There are some other players in the industry, which are focusing on serving the market with various inert ingredient products and capturing a larger market share such as Eastman Chemicals (US), Solvay (Belgium), Evonik (Germany), Huntsman Corporation (US), Akzonobel (The Netherlands), Royal Dutch Shell (The Netherlands), and LyondellBasell Industries (Netherlands).

Recent developments:

- In November 2018, Clariant expanded the production capacity of its ethylene oxide (EO) unit in Gendorf, Germany. The expansion resulted in serving customers of various industries such as personal and home care, crop solutions, and industrial application, with EO-based products.

- In May 2018, Solvay signed a three-year contract with Beifeng Hengtai Agricultural Development Co., Ltd. to launch a product called AgRho NH4 Protect. It is an eco-friendly liquid surfactant, which can be applied on NPK compound that is the most popular fertilizer in China.

- In June 2017, Stepan, through its subsidiary in Mexico, entered into an agreement with BASF Mexicana. This agreement was focused on the acquisition of BASF Mexicana’s surfactant production facility in Ecatepec and a portion of its associated surfactants business.