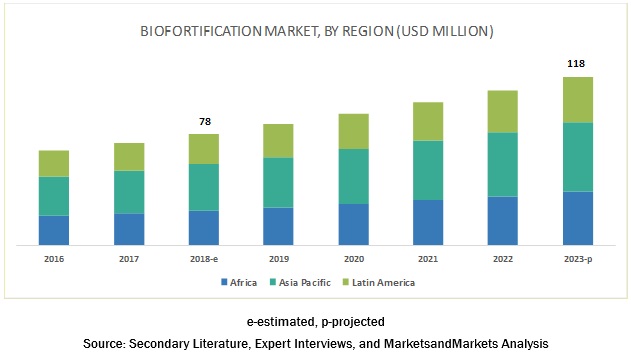

The biofortification market is estimated at USD 78 million in 2018 and is projected to grow at a CAGR of 8.6% from 2018 to reach USD 118 million by 2023. The study involves four major activities to estimate the current market size for biofortification. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Report Objectives:

- To define, segment, and project the global market size for biofortification

- To understand the structure of the biofortification market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38080924

The iron segment is estimated to account for the largest share in the biofortification market in 2018

On the basis of target nutrient, the biofortification market has been segmented into iron, zinc, vitamins, and others such as â-carotene, amino acids, and proteins. The iron segment is estimated to account for the largest share in 2018. Iron is a micronutrient which is required by plants in lesser amounts than primary or secondary micronutrients. It is a constituent of several enzymes and some pigments, and assists in nitrate and sulfate reduction and energy production within the plant.

Sweet potato segment to dominate the biofortification market, by crop, in 2018

The sweet potato segment is estimated to hold the largest share of the global biofortification market in 2018. The demand for biofortified crops such as sweet potato and cassava has increased with the rising technological advancements to increase the nutrient content, particularly in orange-fleshed sweet potato (OFSP). Sweet potato is recognized as an important source of energy in the human diet for centuries owing to its high carbohydrate content. However, its vitamin A content from carotene only became recognized over the past century.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=38080924

Asia Pacific to be the dominant region in the biofortification market in 2018

The Asia Pacific is the dominant region in the biofortification market. Biofortification has strong growth potential in agriculture, and it also improves the nutrition content in food. The biofortification market has grown considerably over the last five years, and this trend is expected to continue in the near future. The growing consumer demand for high nutritional content in food is projected to fuel the demand for biofortified crops, globally.

This report includes a study of marketing and development strategies along with the product portfolios of the leading companies in the biofortification market. It also includes the profiles of leading companies such as Bayer (Germany), Syngenta (Switzerland), Monsanto (US), and DowDuPont (US).

Key Questions Addressed by the Report:

- What are the new target nutrients areas, which the biofortification companies are exploring?

- Which are the key players in the market and how intense is the competition?

- What kind of competitors and stakeholders such as biofortification companies, would be interested in this market? What will be their go-to strategy for this market and which emerging market will be of significant interest?

- How are the current R&D activities and M&As in the biofortification industry projected to create a disruptive environment in the coming years for the agricultural sector?

- What will be the level of impact on the revenues of stakeholders through the benefits of nanotechnology to different stakeholders from rising farmer revenue to environmental regulatory compliance to sustainable profits for the suppliers?