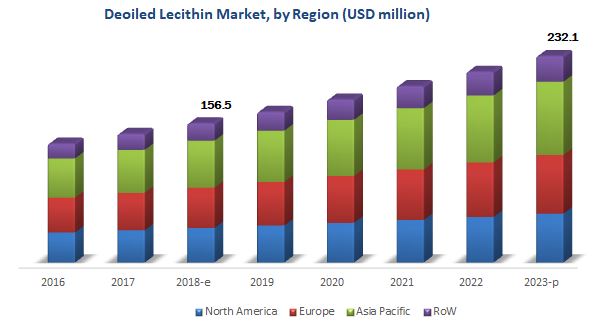

The report "De-oiled Lecithin Market by Source (Soy, Sunflower, Rapeseed, and Egg), Application (Food (Bakery Products, Confectionery Products, Convenience Foods, and Dairy & Frozen Desserts), Feed, and Healthcare), and Region - Global Forecast to 2023", The de-oiled lecithin market is estimated to be valued at USD 156. 5 million in 2018 and is projected to reach USD 232.1 million by 2023, at a CAGR of 8.2% during the forecast period. The market is driven by factors such rise in clean label food, increase in demand of trans-fatty acid and healthy snacking, and the replacement of artificial and synthetic emulsifier with natural and eco-friendly emulsifiers such as de-oiled lecithin in various different regions.

The years considered for the study are as follows:

- Base year: 2017

- Forecast period: 2018–2023

Objectives of the study are as follows:

- Market Intelligence

- Determining and projecting the size of the de-oiled lecithin market with respect to the source, application, and regional presence, over a five-year period ranging from 2018 to 2023

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Competitive Intelligence

- Identifying and profiling key market players in the de-oiled lecithin market

- Understanding the competitive landscape and identifying major growth strategies adopted by the players across the key regions

- Analyzing the regulatory frameworks across regions and their impact on the prominent market players

- Providing insights on key investments in product innovations and technology

- Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=89222733

The food segment is estimated to account for the largest share of the de-oiled lecithin market in 2018.

Increase in health-conscious consumers due to hike in obesity cases in developed regions such as North America and Europe are expected to drive the demand for de-oiled lecithin in the food applications. Further, Asian countries such as China and India are witnessing an increase in demand for healthy and less fatty functional food among consumers in the region. The demand for food products such as sugar confectionery, chocolates, and convenient foods is estimated to increase in the region, subsequently driving the growing demand for de-oiled lecithin. In addition, the population in European and North American countries are facing health issues such as weight gain and obesity. This leads to a shift toward less oily and healthy food ingredients, thus providing a lucrative opportunity for de-oiled lecithin manufacturers for food.

The soybean source is estimated to account for the largest share of the de-oiled lecithin market in 2018.

In terms of volume, the source segment is estimated to account for the largest share of the de-oiled lecithin market in 2018. The demand for soy de-oiled lecithin is expected to increase at a significant rate in animal feed applications, owing to low cost when compared to other types of de-oiled lecithin, which helps reduce the over feed cost and increase yield, especially in developing and emerging countries. Further, the European Food Safety Authority has authorized the use of de-oiled lecithin as feed additives for all animal species boosting the demand for soy de-oiled lecithin in the region.

The confectionery food application is estimated to account for the largest share of the de-oiled lecithin market in 2018.

The confectionery products segment is estimated to be the largest segment in 2018, with USD 34.6 million. De-oiled lecithin is a vital ingredient in chocolate processing. It provides viscosity control, shortens the processing time, and increases the processing stability during the manufacturing of chocolate. Initially, chocolate manufacturers were reluctant to use de-oiled lecithin, as it had to be declared with an E-number under the EU law. However, the rise in prices of cocoa butter has urged manufacturers to shift to de-oiled lecithin as a suitable and cost-effective substitute. Further, in Asia Pacific, China is expected to create lucrative opportunities for manufacturers. Increase in demand for high-quality chocolate is expected to create a robust opportunity, especially for European manufacturers to expand in the country.

Asia Pacific is estimated to account for the largest share of the de-oiled lecithin market in 2018.

In 2018, Asia Pacific is estimated to account for the largest share of the de-oiled lecithin market. Factors such as availability of prominent sources such as soy within the region, increase in awareness toward the benefits of healthy food and feed, growth in demand for non-allergic and organic food, rise in meat consumption, growth of the aquaculture industry, and high investment growth in the pharma and personal care industry have boosted the demand for de-oiled lecithin market in the Asia Pacific region. Furthermore, the growing adoption of a premium lifestyle with quality food and increase in animal husbandry also fuel the de-oiled lecithin market growth in this region.

This report includes a study of the marketing and development strategies, along with the product portfolios of the leading companies. It includes the profiles of leading companies such as DowDuPont (US), Cargill (US), Archer Daniels Midland (US), Bunge Limited (US) and Stern Wywiol Gruppe (Germany). Other players include Lecico GmBH (Germany), American Lecithin Company (US), Lecital (Austria), Lasenor Emul (Spain), GIIAVA (INDIA) PVT. LTD (India), Novastell Essential Ingredients (France), Rasoya Proteins Ltd. (India), Clarkson Grain Company, Inc. (US), Amitex Agro Product Pvt. Ltd. (India), and Austrade Inc. (US).